Brewed to Perfection: Coffee Brewing Mastery

Unlock the secrets of perfect coffee brewing with expert tips, techniques, and recipes.

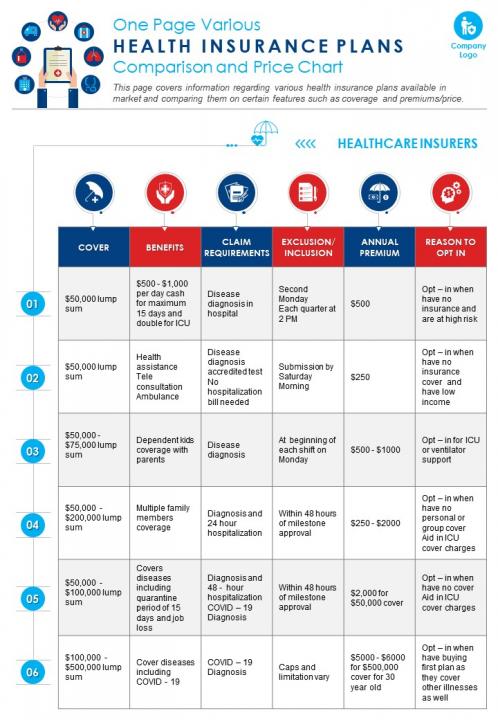

Insurance Showdown: Who's the Best in Your Corner?

Discover the ultimate insurance showdown! Uncover who truly has your back and get the best coverage for your needs today!

Top 5 Insurance Providers: Pros and Cons Explained

When choosing an insurance provider, it's essential to consider the pros and cons of each option. Here are the top 5 insurance providers that stand out in the market:

- Provider A: Known for their competitive pricing and exceptional customer service, but may have limited coverage options.

- Provider B: Offers a wide range of policies and flexible payment plans, although their claims process can be slow.

- Provider C: Highly rated for online tools and accessibility; however, some customers report dissatisfaction with their claims adjustments.

- Provider D: Praised for their comprehensive coverage and discounts for safe driving, yet their premiums can be higher than average.

- Provider E: Famous for niche coverage plans suited for unique needs, yet they may lack the reputation found in larger companies.

It’s crucial to weigh the advantages and disadvantages of each provider to make an informed decision. For instance, while Provider A excels in customer support, Provider B might offer more affordable options. Evaluating factors such as pricing, customer service, claims processing, and policy flexibility will help you choose the right insurance provider that meets your specific needs. Remember, the best provider for one person may not be the best for another;

the right choice largely depends on your individual circumstances and preferences.

Understanding Policy Types: What You Need to Know

When exploring insurance options, understanding policy types is crucial to making informed decisions. Generally, these policies fall into several main categories, including life insurance, health insurance, auto insurance, and homeowners insurance. Each category serves a unique purpose and offers different levels of coverage, so it's important to assess your individual needs. For instance, while life insurance provides financial support for your beneficiaries after your passing, health insurance offers coverage for medical expenses. Understanding these distinctions can help you choose the right products for your financial planning.

Additionally, within each category of policy types, you may encounter various subtypes. For example, auto insurance can include liability coverage, collision coverage, and comprehensive coverage. When selecting a policy, consider the following factors:

- Your personal assets

- Your health status

- Your driving habits

- The structure of your home

How to Choose the Right Insurance for Your Needs?

Choosing the right insurance for your needs involves a thorough assessment of your individual circumstances and future goals. Start by evaluating your current situation—consider your income, assets, and existing liabilities. This foundational analysis will help you determine the types of insurance you require, whether it's health, life, auto, or property insurance. Additionally, think about your unique lifestyle and how certain risks may affect you. For instance, if you own a home, homeowners insurance is essential to protect against damages or loss.

Once you have a clear picture of your needs, it’s crucial to compare different insurance policies and providers. Look for coverage options that suit your lifestyle while also checking the premiums, deductibles, and limits. Utilize online resources or speak with insurance agents to gather quotes and understand the specifics of each policy. Finally, don't hesitate to ask questions and seek clarification on terms or conditions that may be unclear, ensuring you make an informed decision that best protects you and your assets.