Brewed to Perfection: Coffee Brewing Mastery

Unlock the secrets of perfect coffee brewing with expert tips, techniques, and recipes.

Insurance Showdown: Finding the Best Coverage Without Breaking a Sweat

Uncover the secrets to effortless insurance shopping! Find the best coverage without the stress and save big today!

Top 5 Tips for Choosing the Right Insurance Coverage

Choosing the right insurance coverage can be a daunting task, but it is crucial for protecting your assets and ensuring peace of mind. Tip 1: Assess your needs thoroughly. Start by evaluating the specific coverage requirements for your situation, whether it's for health, auto, or home insurance. Understanding your personal or business needs will help you narrow down the options available to you.

Tip 2: Compare multiple providers. It's essential to research and compare quotes from various insurance companies to find the best coverage at competitive rates. Pay close attention to the policy details, including deductibles and exclusions, to avoid unexpected surprises. Tip 3: Read customer reviews and ratings, as they can provide insight into the service quality and claims process of each provider. Making an informed decision can save you money and ensure you have the right insurance when you need it most.

How to Compare Insurance Policies Like a Pro

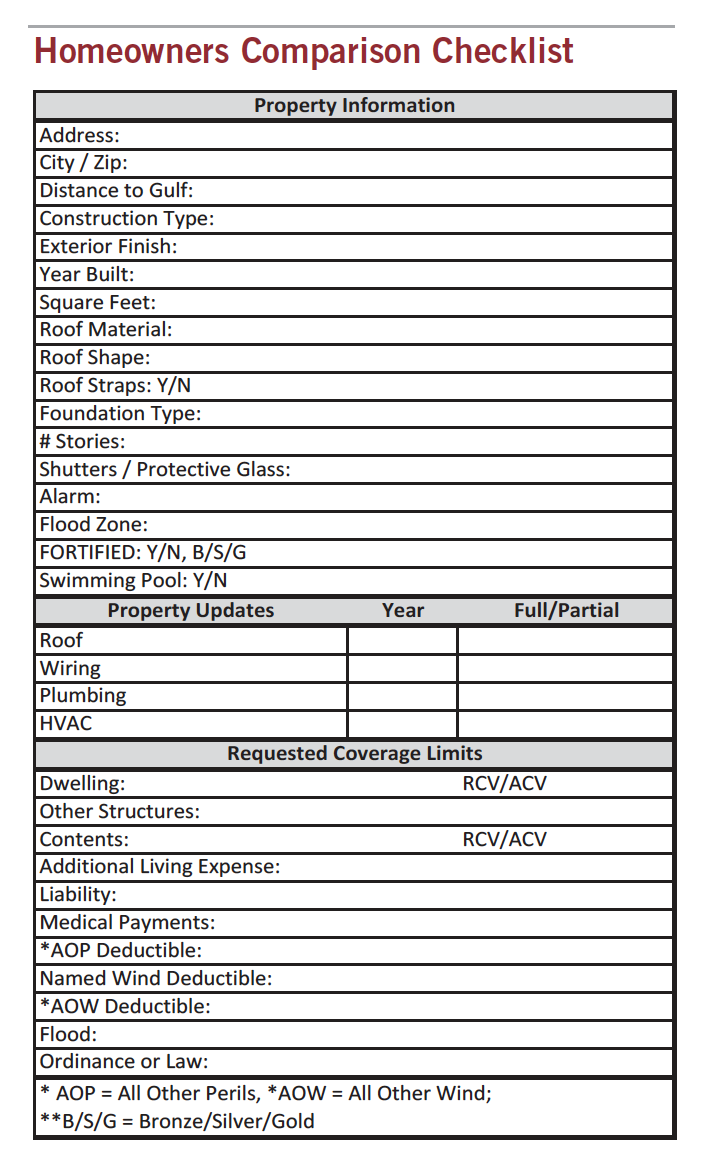

When it comes to comparing insurance policies, understanding the key features and terms is essential. Start by creating a comprehensive list of the types of coverage you need, whether it's for auto, health, home, or life insurance. Next, gather quotes from multiple providers to ensure you have a wide range of options. Use a spreadsheet to organize important details such as premiums, deductibles, coverage limits, and exclusions. This way, you can visually assess which policies offer the best value for your needs.

Another crucial step in learning how to compare insurance policies like a pro is to read the fine print. Don’t just focus on the premium costs; pay attention to the terms and conditions that come with each policy. Look for customer reviews and ratings to gauge customer satisfaction and the company’s claim handling process. Finally, consider consulting an insurance agent or broker who can provide professional insights tailored to your unique situation, helping to clarify any complex jargon and ensuring that you make an informed decision.

What Are the Key Factors to Consider When Buying Insurance?

When it comes to purchasing insurance, there are several key factors to consider to ensure that you select the right policy for your needs. First, assess your coverage requirements based on your personal circumstances. For instance, car insurance varies based on your vehicle type, driving history, and state regulations. Similarly, health insurance plans can differ significantly based on your medical needs, family size, and budget. Be sure to evaluate the deductibles, premiums, and co-pays involved in each option.

Another crucial factor to consider is the reputation and financial stability of the insurance provider. Researching customer reviews, ratings from agencies like A.M. Best or Standard & Poor’s, and the company’s claim settlement ratio can provide you with insights into their reliability. Additionally, understanding the terms of the policy, including exclusions and coverage limits, is vital. Make sure you are well-informed, as this will help you avoid any surprises when you need to file a claim.