Brewed to Perfection: Coffee Brewing Mastery

Unlock the secrets of perfect coffee brewing with expert tips, techniques, and recipes.

Why Whole Life Insurance is the Best-kept Secret for Financial Freedom

Discover how whole life insurance can unlock your path to financial freedom—uncover this powerful secret today!

Unlocking Financial Freedom: How Whole Life Insurance Works for You

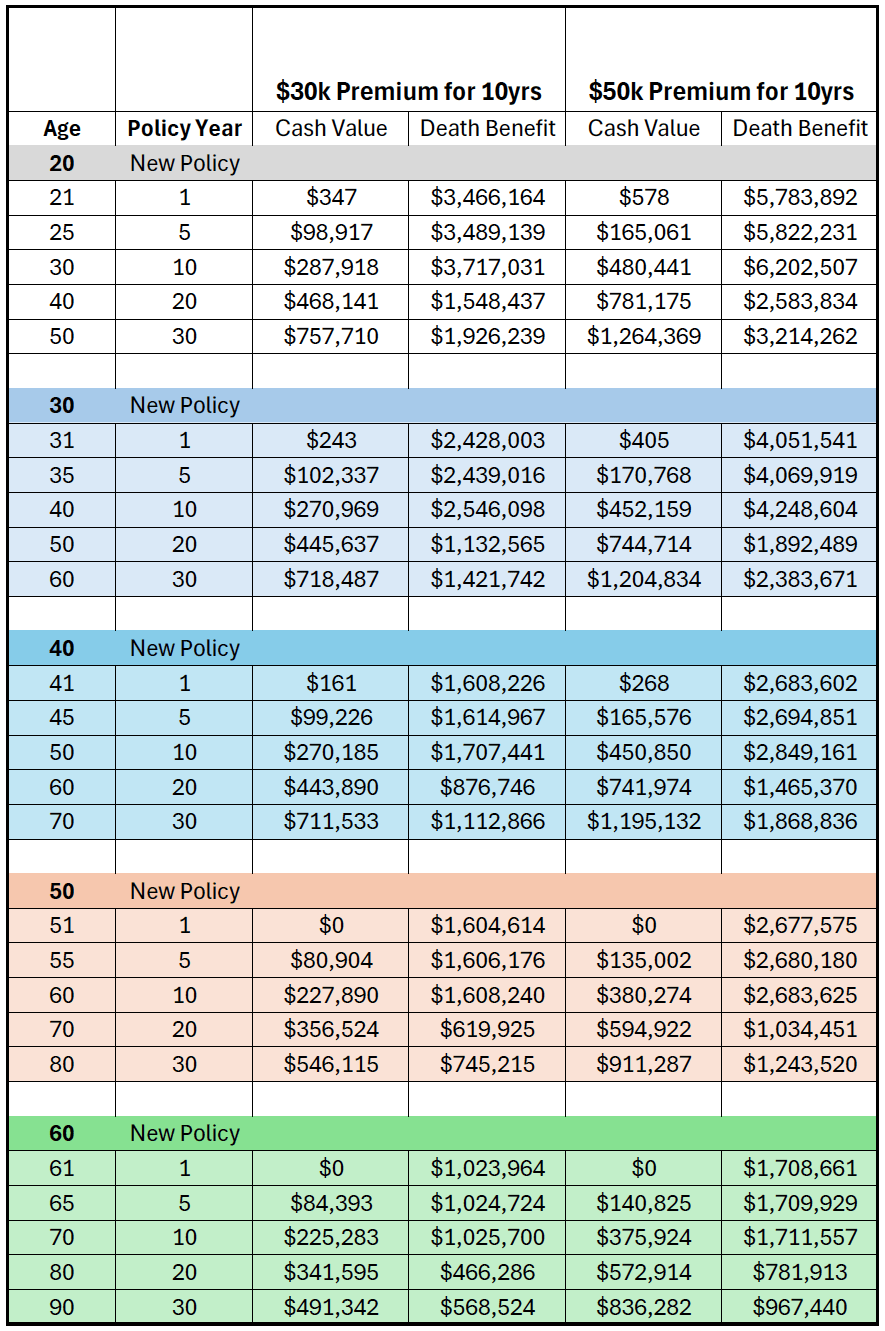

Unlocking financial freedom can often feel like a daunting task, but one option to consider is whole life insurance. Unlike term life insurance, which expires after a set period, whole life insurance provides coverage for your entire life as long as premiums are paid. This type of insurance not only offers a death benefit to your beneficiaries but also accumulates cash value over time. This cash value can be accessed through loans or withdrawals, providing a financial resource that can be utilized for various needs, such as funding education or starting a business.

Understanding how whole life insurance works is crucial for maximizing its benefits. The premiums you pay contribute to both the insurance coverage and the cash value component, which grows at a guaranteed rate. Additionally, whole life insurance policies often pay dividends, which can further enhance your cash value. By leveraging this accumulation, you can create a pathway to financial freedom by potentially using the funds for investments or unexpected expenses, all while ensuring your loved ones are protected financially in the event of your passing.

The Hidden Benefits of Whole Life Insurance: More Than Just a Policy

Whole life insurance offers a range of benefits that often go unnoticed by many potential policyholders. Beyond simply providing a death benefit to loved ones, these policies accumulate cash value over time. This cash value component can serve as a financial resource, allowing policyholders to borrow against their policy or withdraw funds as needed. Such liquidity can be a crucial financial tool in times of unexpected expenses or investment opportunities, making whole life insurance a versatile option for long-term financial planning.

Moreover, whole life insurance policies provide a sense of stability with their guaranteed death benefit and fixed premiums. Unlike term life insurance, which expires after a set period, whole life ensures that beneficiaries will receive a payout as long as the policy remains in force. This not only secures your family’s financial future but also can play a role in estate planning, helping to cover taxes and ensuring that your assets are passed on seamlessly. In essence, whole life insurance is not just a safety net; it’s an integral part of a comprehensive financial strategy.

Is Whole Life Insurance the Secret to Building Wealth Over Time?

When considering the best strategies for wealth accumulation, many individuals often overlook the potential of whole life insurance. This type of insurance not only provides a death benefit but also acts as a savings vehicle that can grow in cash value over time. Unlike term life insurance, which offers coverage for a predetermined period, whole life insurance remains in effect for the policyholder’s lifetime, making it a long-term financial tool. As the cash value accumulates, it can be accessed through loans or withdrawals, allowing policyholders to leverage their investment in times of need.

In addition to its cash value component, whole life insurance comes with several advantages that make it a compelling option for wealth building. First, the cash value grows at a guaranteed rate, offering stability amidst market fluctuations. Second, the death benefit provides financial security for your loved ones, ensuring they are protected even in your absence. Lastly, the ability to borrow against the policy without affecting credit scores makes whole life insurance a flexible solution for managing unexpected expenses while simultaneously fostering a long-term wealth strategy.