Brewed to Perfection: Coffee Brewing Mastery

Unlock the secrets of perfect coffee brewing with expert tips, techniques, and recipes.

The Secret Life of Insurance Quotes

Uncover the hidden truths behind insurance quotes! Discover tips, tricks, and secrets that can save you money and peace of mind.

Unveiling the Mystery: How Insurance Quotes Are Calculated

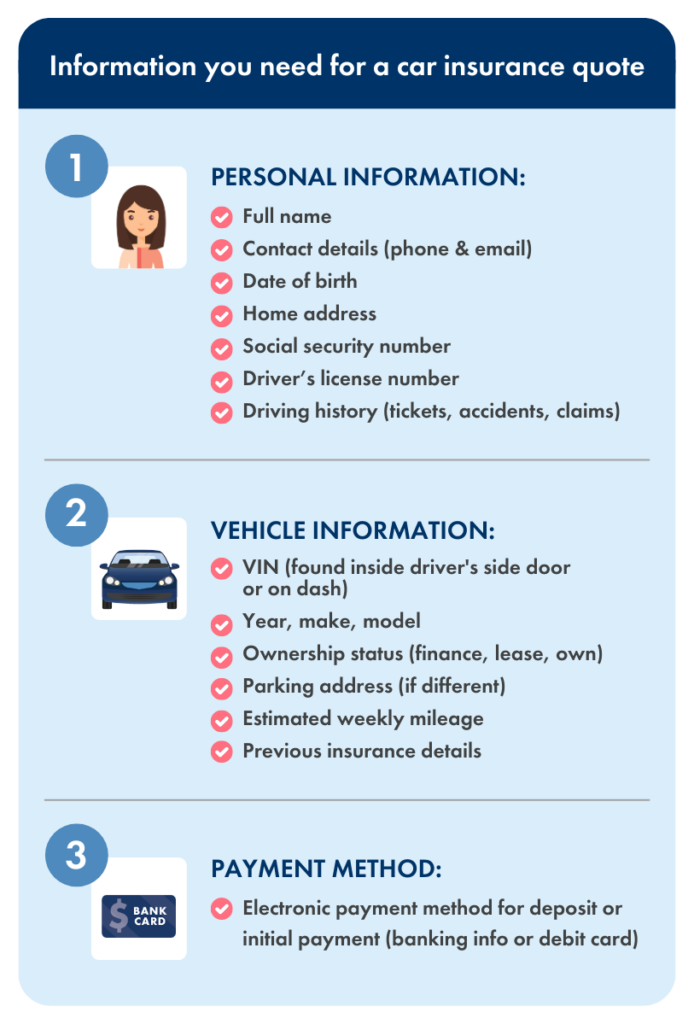

Understanding how insurance quotes are calculated can seem daunting, but it involves a systematic assessment of various factors. Initially, insurance companies gather data about the applicant, including age, location, driving history, and the type of coverage desired. These details help insurers evaluate the level of risk associated with providing coverage. For example, a younger driver with a history of accidents may receive a higher quote than an experienced driver with a clean record. Additionally, the insurance quote process may also consider external factors such as the make and model of the vehicle, local crime rates, and even credit scores, all of which contribute to determining premium rates.

Once the relevant information has been collected, insurance companies employ complex algorithms and actuarial analysis to calculate the final insurance quote. These algorithms weigh the gathered data against statistical models to predict potential claims and losses. In some cases, insurers may offer discounts for safe driving habits, bundling policies, or maintaining a good credit score, thereby lowering the overall cost. It's essential for consumers to shop around and understand what influences their insurance quotes, as this knowledge empowers them to make informed decisions and potentially save money on their policies.

Top 5 Myths About Insurance Quotes Debunked

When it comes to understanding insurance quotes, a number of myths can cloud your judgment and lead to misconceptions. One prevalent myth is that getting multiple insurance quotes is unnecessary. In reality, comparing quotes from different providers is essential to ensure you're getting the best coverage for your money. Each insurance company has its own criteria for determining rates, so by gathering multiple quotes, you can make an informed decision based on your unique needs and budget.

Another common myth is that your credit score has no impact on your insurance quotes. This is simply not true; many insurers consider your credit history as part of their risk assessment process. A higher credit score often correlates with lower premiums. Thus, maintaining a good credit score can significantly influence the insurance quotes you receive. Understanding these myths can empower consumers to make smarter choices when it comes to their insurance needs.

What Factors Impact Your Insurance Quote?

When it comes to determining your insurance quote, several key factors play a crucial role. First and foremost, your personal information is essential. This includes your age, gender, and marital status, all of which can influence the perceived risk associated with insuring you. For instance, younger drivers might face higher premiums due to their lack of experience, while married individuals often benefit from lower rates. Additionally, your credit score is a major determinant; insurers use it as a gauge of your financial responsibility, impacting your overall insurance quotes.

Another significant factor is your driving history. Insurers typically assess your track record for any accidents, tickets, or claims in the past few years. A clean driving record can lead to lower insurance quotes, while a history of infractions can increase costs dramatically. Moreover, the type of coverage options you choose, such as deductibles and add-ons for uninsured motorist coverage, will further influence your total premium. Overall, understanding these factors can empower you to seek the best possible insurance quote and make informed choices about your coverage.